Cost-of-living adjustments

Your monthly pension payment may increase to reflect increases in the cost of living.

During retirement, your monthly pension payment may increase because of an annual cost-of-living adjustment (COLA).

This adjustment may be added to your pension to help it keep pace with increases in the cost of living. A COLA is based on the Canadian consumer price index and applied to your pension starting in January each year if there are sufficient funds available in the plan’s inflation adjustment account (IAA).

As part of your pension contributions, one per cent of your salary is transferred to the IAA, which is a fund used to help offset the effects of inflation.

The amount of the annual COLA you receive, if any, depends on the amount of money in the IAA available to pay for an increase. Increases can be applied to both the lifetime portion of your pension plan and the bridge benefit.

Although future COLAs are not guaranteed, once you have received an adjustment, it becomes part of your basic lifetime pension for all following years.

In your first year of retirement, your COLA adjustment is pro-rated according to the number of months you’ve been retired.

If the cost of living goes down, your pension payment will not decrease. You will simply not receive an increase for that year.

The pension statement you receive in January will state the percentage and amount of the COLA, if any, for the coming year.

Calculating the COLA

You may have noticed some pension plans have COLA amounts that are different from yours. That’s because BC public sector pension plans have different ways of calculating the COLA. In general, different calculation methods generate different annual COLA amounts. The good news is that no method produces results that are consistently higher or lower than the others over multiple years.

Calculation methods

The COLA is calculated using monthly rates from the Canadian consumer price index (CPI). Your plan uses the difference between September CPIs. With this method, the COLA is based on the percentage change between the current year’s September CPI and the previous September’s CPI.

Other BC public sector pension plans may use the annual percentage change in the average CPI. With this method, the COLA is based on the annual percentage change in the 12-month average CPI from one year to the next. Each year, that average, from November to October, is compared to the average for the 12-month period that came before it. The difference between the two 12-month periods becomes the COLA.

Example

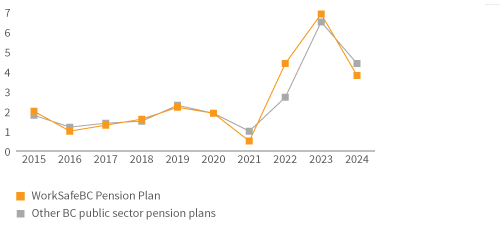

In some years, one method generates a higher COLA; in some years, the other method generates a higher amount.

COLA methodologies comparison (%)

Because of COLA/inflation adjustment caps, some plans did not grant the full COLA/inflation adjustment amounts determined by their plan's methodology in certain years.

Cost-of-living adjustment history

| Year | Increase (%) |

|---|---|

| 2024 | 3.8 |

| 2023 | 6.9 |

| 2022 | 4.4 |

| 2021 | 0.5 |

| 2020 | 1.9 |

| 2019 | 2.2 |

| 2018 | 1.6 |

| 2017 | 1.3 |

| 2016 | 1.0 |

| 2015 | 2.0 |

| 2014 | 1.1 |

| 2013 | 1.2 |

| 2012 | 3.2 |

| 2011 | 1.0 |

| 2010 | 0.0 |

| 2009 | 3.4 |

| 2008 | 2.5 |

| 2007 | 0.7 |

| 2006 | 3.4 |

| 2005 | 1.8 |

| 2004 | 2.2 |

External link for cost-of-living adjustments

See Statistics Canada's publication Your Guide to the Consumer Price Index for information on how the consumer price index is calculated.