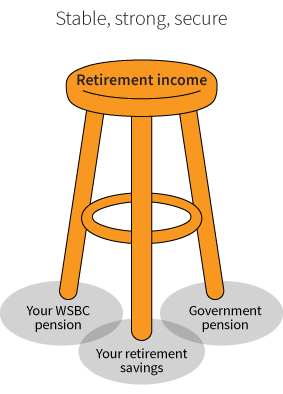

How sturdy is your retirement income?

Learn about the sources of income that can help you build a solid financial plan for retirement.

Your WorkSafeBC pension

Your WorkSafeBC pension

In the three-legged stool scenario, you can count on your WorkSafeBC pension as a solid support. As a defined benefit pension plan, it will provide you with a dependable and regular source of income for your lifetime.

But how much income will it actually provide? A great advantage of a defined benefit plan is that you can get a much better sense of your potential annual pension income than you could if you were a member of a defined contribution plan.

Spend a bit of time using the personal pension estimator in My Account to see what your pension payments might be and to explore different retirement scenarios and pension options. What happens if you retire early? Can you buy back service for a leave of absence to increase your pension? How do different pension options affect your potential monthly pension payments? Your Member’s benefit statement is also a good source of information.

Government pensions

Of course, your WorkSafeBC pension won’t be your only source of retirement income. Government pensions, such as the Canada Pension Plan (CPP) and the old age security (OAS) pension are other sources of income after you stop working.

CPP pays you a monthly income when you retire. The amount you receive is based on how long you’ve contributed to CPP and the amount of your contributions. You can apply as early as age 60, although your payments will be lower than if you apply for CPP at a later age.

You may also be eligible for an OAS pension if you meet citizenship and residency requirements.

You have to apply directly for these two government pensions when you are ready to receive them.

A useful tool for estimating your retirement income is the federal government’s Canadian Retirement Income Calculator. This online tool can help you estimate your retirement income from both your workplace pension and government pension sources.

Once you have a sense of your potential annual retirement income from your WorkSafeBC pension and government pensions, you’ll be in a better position to know if there’s a shortfall between what you will need and what you will have.

Personal savings

Personal savings are the final leg of the three-legged stool. Tax-Free Savings Accounts and Registered Retirement Savings Plans (RRSPs) are often used to save money for long-term goals such as retirement.

Many people wonder if you can contribute to an RRSP when you are a member of a pension plan. The answer is yes. However, the amount you are allowed to contribute to an RRSP will be lower because you are already contributing to a registered pension plan.

Knowledge is power

Planning for your retirement is time well spent. Just a few minutes with the personalized pension estimator and a half-hour on the government’s Canadian Retirement Income Calculator is a great way to see if you are on track for the retirement income you’ll need.

Remember, your WorkSafeBC pension is just one of the three legs on the stool of retirement income. You also need to think about the other two supports: government pension programs and your personal savings. You want to make sure that these two legs are in place, and that they are sturdy enough to provide you with the support you need when you retire.

Remember, your WorkSafeBC pension is just one of the three legs on the stool of retirement income.

My Account - anytime, anywhere

Check your My Account profile regularly to update and manage your personal information.Sign in to My Account