Pension Life - 2024

Working for you

Message from the Pension Committee

Do you know you are among more than 2,500 retirees collecting their WorkSafeBC pension?

We know retirees and their families count on the WorkSafeBC Pension Plan for a stable source of income. The Pension Committee’s role is to ensure the plan remains secure now and in the future. There are many tools we use to achieve this. These tools include regular valuations by an independent actuary. We also provide guidance on investments through our Statement of Investment Policies and Procedures.

You are our focus as we support WorkSafeBC, under the direction of the Board of Directors, with the administration of the pension plan.

We’re pleased to share with you the following updates about your WorkSafeBC Pension Plan.

COLA for 2024 is 3.8 per cent

A cost-of-living adjustment (COLA) can help to preserve the purchasing power of your pension as the price of goods and services rises. COLAs are calculated using the monthly rates from the Canadian consumer price index (CPI). The CPI is a measure of changes in the cost of goods and services and is calculated by Statistics Canada. Your plan bases COLA decisions on the percentage change between the current year’s September CPI and the previous September’s CPI.

Other plans may use different methods to calculate COLA, but no method results in consistently higher or lower COLAs when averaged over multiple years.

The Pension Committee monitors the plan’s ability to pay for COLAs. These increases are not guaranteed. Every year, we review the funding available in the plan’s inflation adjustment account to determine if a COLA can be provided.

We are pleased to announce that you received a 3.8 per cent COLA on your pension effective January 1, 2024.

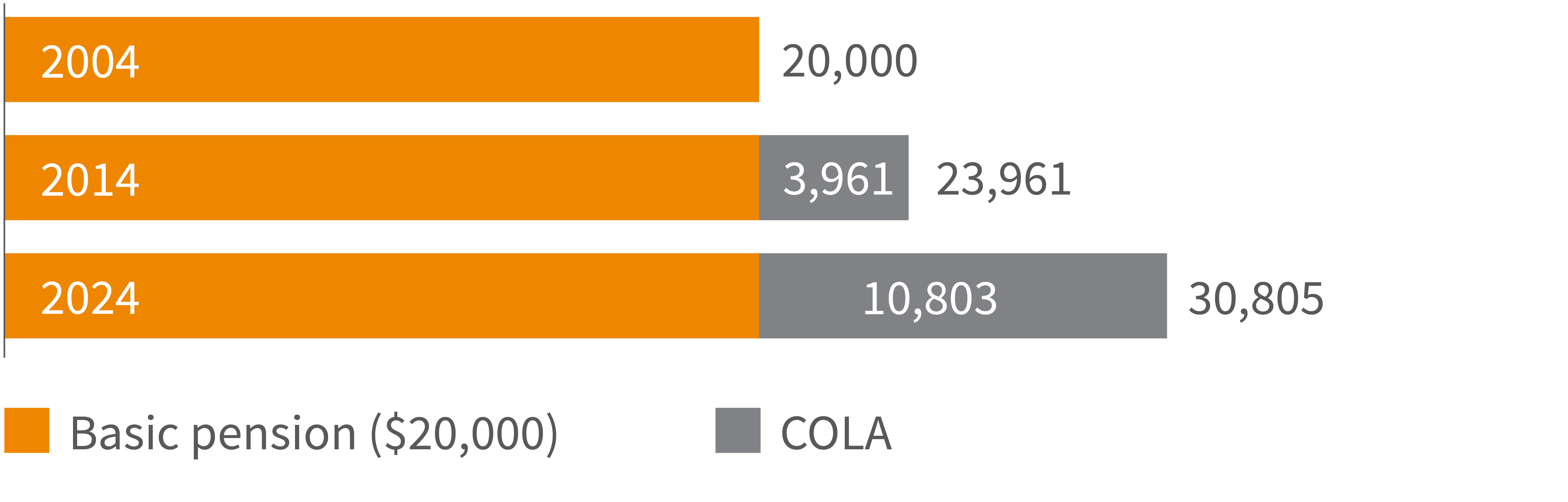

The graph below shows how an average pension granted 20 years ago has grown due to COLAs.

Basic pension plus COLA granted ($)

Learning resources designed to help you

The plan website has helpful content for people at every stage of their retirement.

Want to learn more about the listed topics? Check out the Articles link under related content.

- Health and dental coverage

- Tax tips for retirees

- Staying “cyber safe” and avoiding fraud online

- How your pension payments and COLAs work

Still have questions? Sign in or register for My Account to access Message Centre, which lets you send messages to the plan.

In My Account, you have the option to go paper-free and receive email notifications when new information about your pension is available. This includes digital tax slips and annual pension statements.