After retirement - WorkSafeBC

Guide for plan members

WorkSafeBC Pension Plan is committed to helping you make the most of your pension. This guide is a provincial requirement. Please use the links at right to explore the topics most relevant to you.

Cost-of-living adjustments

During retirement, your monthly pension payment may increase because of an annual cost-of-living adjustment (COLA).

This adjustment may be added to your pension to help it keep pace with increases in the cost of living. A COLA is based on the Canadian consumer price index and applied to your pension starting in January each year if there are sufficient funds available in the plan’s inflation adjustment account (IAA).

As part of your pension contributions, one per cent of your salary is transferred to the IAA, which is a fund used to help offset the effects of inflation.

The amount of the annual COLA you receive, if any, depends on the amount of money in the IAA available to pay for an increase. Increases can be applied to both the lifetime portion of your pension plan and the bridge benefit.

Although future COLAs are not guaranteed, once you have received an adjustment, it becomes part of your basic lifetime pension for all following years.

In your first year of retirement, your COLA adjustment is pro-rated according to the number of months you’ve been retired.

If the cost of living goes down, your pension payment will not decrease. You will simply not receive an increase for that year.

The pension statement you receive in January will state the percentage and amount of the COLA, if any, for the coming year.

Calculating the COLA

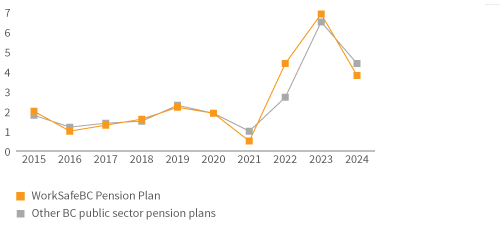

You may have noticed some pension plans have COLA amounts that are different from yours. That’s because BC public sector pension plans have different ways of calculating the COLA. In general, different calculation methods generate different annual COLA amounts. The good news is that no method produces results that are consistently higher or lower than the others over multiple years.

Calculation methods

The COLA is calculated using monthly rates from the Canadian consumer price index (CPI). Your plan uses the difference between September CPIs. With this method, the COLA is based on the percentage change between the current year’s September CPI and the previous September’s CPI.

Other BC public sector pension plans may use the annual percentage change in the average CPI. With this method, the COLA is based on the annual percentage change in the 12-month average CPI from one year to the next. Each year, that average, from November to October, is compared to the average for the 12-month period that came before it. The difference between the two 12-month periods becomes the COLA.

Example

In some years, one method generates a higher COLA; in some years, the other method generates a higher amount.

COLA methodologies comparison (%)

Because of COLA/inflation adjustment caps, some plans did not grant the full COLA/inflation adjustment amounts determined by their plan's methodology in certain years.

Health care benefits after you retire

When you retire, your health care coverage as a WorkSafeBC employee will end. As a retired employee of WorkSafeBC, some health care costs will still be covered by the extended health care benefits for employees who retire directly from active employment to a pension.

You can also apply for optional dental coverage; however, you are responsible for paying the monthly premiums.

Retiree health benefits are contingent; that is, they are not guaranteed and coverage may be changed.

Eligibility requirements

You are eligible for extended health care coverage immediately after you retire if you:

- Were covered by WorkSafeBC’s group benefit plans as an active plan member immediately before you began receiving your WorkSafeBC pension

- Retired directly from active employment (including long-term disability) to a pension

- Have medical coverage under the government plan in your province of residence

If you deferred your pension, you are not eligible for extended health care benefits. However, you can apply for voluntary dental coverage.

Medical coverage in retirement

Your extended health care plan covers some medical costs. Specific services and supplies are subject to a maximum coverage, and you may need to pay a deductible.

The amount of coverage depends on your employee group. Please refer to the booklet specific to your employee group for details about eligible expenses, maximum reimbursement and deductibles. Your booklet also describes how to submit claims for your eligible expenses.

What is the cost for this coverage?

If you meet the eligibility requirements, WorkSafeBC will pay the monthly premiums for your extended health care coverage. These premiums are not a taxable benefit.

Dependants and your health benefits

Coverage for your dependant is the same whether you are retired or an active employee. However, after you retire, you cannot add new dependants for benefit coverage.

Depending on the pension option you chose at retirement, your dependants may need to seek benefit coverage from another provider when you die.

How to enrol for retirement health benefits

Apply directly with WorkSafeBC Total Rewards when you apply for your pension.

Returning to work after retirement

You may decide to return to work after you retire and have been receiving a pension from the WorkSafeBC Pension Plan.

Working for a new employer

If you begin working for an employer other than WorkSafeBC, you will continue to receive your WorkSafeBC pension.

Although you are no longer eligible to contribute to the WorkSafeBC Pension Plan, you may be eligible to contribute to your new employer’s pension plan, if they have one. Talk to your new employer for details.

Working for WorkSafeBC

If you begin working for WorkSafeBC as a retired member, you will continue to receive your WorkSafeBC pension. Contact WorkSafeBC Total Rewards to confirm you are a retired member so that WorkSafeBC does not deduct pension contributions from your pay.

Death and your pension

The type and amount of any death benefit depends on:

- Your age when you die

- Whom you named as beneficiaries

- Whether you die before or after starting your pension

Shortened life expectancy

If you are an active member of the plan and have a shortened life expectancy, you may be able to access your pension early. Contact the plan for more information.

If you die after you start receiving your pension

The pension option you chose when you retired determines what happens next. The type and amount of a death benefit depends on whether you:

- Chose a single-life or joint-life pension option

- Chose a guarantee period

- Died before or after a guarantee period

Examples:

- If you chose a single life pension with a guarantee period, and you die before that period expires, your monthly pension will continue to be paid to your beneficiaries until the end of the guarantee period. Alternatively, your beneficiaries may choose to receive a lump-sum payment.

- If you chose a joint life pension with a guarantee period, and you die before the guarantee period expires, your full monthly pension will be paid to your spouse until the end of the guarantee period, after which the joint life percentage you selected will be paid to your spouse for their lifetime.

If your beneficiary is an organization, any remaining monthly pension payments will be paid to the organization as a lump sum.

Your spouse and dependent children may be eligible for extended health care and dental coverage through the plan after your death. Certain conditions apply, and coverage is not guaranteed.

If you die before you start receiving your pension

If you die before you retire, your beneficiaries will be paid a death benefit.

Your spouse is automatically your beneficiary unless they waived their right to a pre-retirement death benefit. If your spouse is your beneficiary, their options depend on your age when you die:

- If you die before your earliest retirement age of 55, your spouse may choose:

- an immediate monthly pension, payable for their lifetime

- a lump-sum payment equal to the value of your contributions with interest, or the lump-sum commuted value of your pension, whichever is greater

The commuted value of your pension is the amount of money the pension plan would need to put aside today, at current interest rates, to pay for your future pension at retirement.

- If you die after age 55, your spouse is only eligible to receive an immediate monthly pension, payable for their lifetime

If you do not have a spouse or your spouse has waived their right to a pre-retirement death benefit, your beneficiaries will receive a lump-sum death benefit equal to the greater of:

- Your contributions with interest

- The lump-sum commuted value of your pension

The commuted value of your pension is the amount of money the pension plan would need to put aside today, at current interest rates, to pay for your future pension at retirement.

If you do not have a spouse and have not named a beneficiary through the plan or in your will, the benefit is paid to your estate.

When paying death benefits to a former spouse, we follow the terms in your signed separation agreement or registered court order.

Looking for more detail? These links will help you

How pension contributions work

Taking time off work and buying service

Leaving WorkSafeBC and your pension plan

Beneficiaries and your pension