Nearing retirement - WorkSafeBC

Guide for plan members

WorkSafeBC Pension Plan is committed to helping you make the most of your pension. This guide is a provincial requirement. Please use the links at right to explore the topics most relevant to you.

When you can retire

While the normal age of retirement is 65, you can choose to retire as early as 55 or as late as the year in which you turn 71. Your age at retirement will affect the value of your pension.

The age at which you choose to retire will affect the value of your pension.

The earliest age you can start receiving your pension is 55. The latest is the end of the year in which you turn 71.

Eligibility for an unreduced pension

Your age at retirement and your years of contributory service will determine if you are eligible for an unreduced pension.

You will receive an unreduced pension if, at the date of your retirement, you are:

- Age 55 or older and your age plus your years of contributory service equals 90

- Age 60 or older, with two or more years of contributory service

- Age 65 or older, with any amount of contributory service

For example, if you are 57 and have 33 years of contributory service, you are eligible for an unreduced pension because your age plus your years of contributory service equals 90.

If you are 60 and have two years of contributory service, you are also eligible for an unreduced pension.

If you do not apply to start your unreduced pension when you are eligible, you will not be entitled to have your pension backdated to a previous date. You are responsible for choosing the date your pension will start and you must apply to start your pension.

You will receive a reduced pension, if, at the date of your retirement, you are:

- Over 55 but under 60, and your age plus your years of contributory service is less than 90

- Over 60 but under 65, with fewer than two years of contributory service

For example, if you are 57 and have 20 years of contributory service, you are not eligible for an unreduced pension. If you choose to retire, you will receive a reduced pension because your age plus your years of contributory service does not equal 90.

If you are an inactive member working for an employer other than WorkSafeBC, you may apply to begin receiving your pension as early as at age 55.

To learn more about how the changes may affect your pension, sign in to My Account and use the personalized Pension Estimator to find out what your monthly pension might be based on your salary and years of service.

You may want to talk to an independent financial advisor about which start date is best for you and your situation.

How we calculate your pension

Your lifetime monthly pension payment is calculated based on your pensionable service (to a maximum of 35 years) and average of your highest five years of salary. Your age at retirement and chosen pension option also determine the value of your monthly pension payment.

The following formula is used to calculate your pension based on a single life pension guaranteed for 10 years:

Before age 65

2% × five-year highest average salary (HAS) × total pensionable service

This formula includes the bridge benefit.

At age 65 and after

2% × HAS × total pensionable service

minus the bridge benefit, which is calculated as follows:

0.7% × (lesser of previous year's maximum pensionable earnings or HAS)

× pensionable service

This pension formula is used to calculate a lifetime monthly pension amount. The actual monthly pension payment you receive will depend on several other factors, including:

-

Your age when you retire

-

The pension option you choose

-

If you retire when you are younger than 65 and do not meet the criteria for an unreduced pension

After you retire, your monthly pension payment may increase if there is an annual cost-of-living adjustment (COLA). This adjustment is added to your pension and, if applicable, your bridge benefit, to help keep pace with increases to the cost of living.

COLA is based on the Canadian consumer price index and is applied to your pension in January each year if sufficient funds are available in the plan's inflation adjustment account.

Although future COLAs are not guaranteed, once you have received the adjustment it becomes part of your lifetime pension for all subsequent years.

Calculating your reduced pension

The amount of your monthly pension payment will be reduced if you decide to retire early and do not meet the eligibility criteria for an unreduced pension.

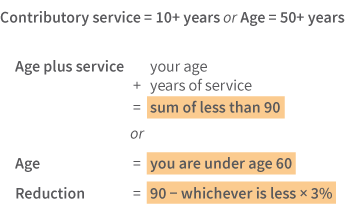

If you have at least 10 years of contributory service and are at least 50 when your employment ends at WorkSafeBC, your pension will be reduced by three per cent for each year using the lesser of the age plus service or age rule:

- Age plus service rule—the sum of your age plus years of contributory service is less than 90

- Age rule—you are under age 60

In all other cases, your pension will be reduced by five per cent for each year under the age of 65.

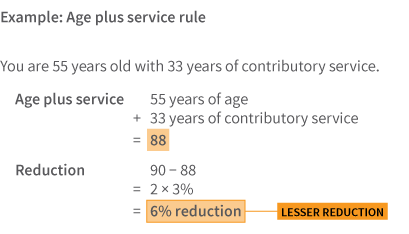

For example, if you are 55 and have 33 years of service, your reduction would be six per cent based on the age plus service rule:

(90 - 88 [88 is the sum of your age and years of service] = 2) x 3% = 6%

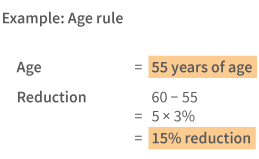

We use the lesser of the age plus service rule or age rule. If we used the age rule, your pension reduction would be 15 per cent:

60 - 55 = 5 x 3% = 15%

If you end your employment at WorkSafeBC with fewer than two years of contributory service, your pension will be reduced by five per cent per year for every year you are under 65.

For example, if you are 55 and have one year of contributory service, your reduction would be 50 per cent:

65 - 55 = 10 x 5% = 50%

Pension reductions are pro-rated by month for partial years of contributory service.

Who is the beneficiary of your pension?

Your pension gives you a secure and lifelong source of income after you retire. In addition to the financial security it provides you, your pension can also provide financial security to your beneficiaries – your family, other people or organizations – after your death.

If you are not married and have not named a beneficiary, your estate is automatically your beneficiary when you die.

If you are married or in a common-law relationship of more than two years, your spouse is automatically your beneficiary. However, your spouse can formally waive their rights to the pension benefit they would receive if you die.

If your spouse has given up their rights to both the minimum 60 per cent lifetime survivor's benefit and their beneficiary rights, you can name other people or organizations as your beneficiary. These can include a combination of:

- People

- Organizations (such as societies, charities, trusts or corporations)

- Trusts

You can name one or more alternate beneficiaries for each beneficiary. This means that if a beneficiary dies before you, an alternate beneficiary or beneficiaries may receive your pension benefit when you die.

You can also name your estate as your beneficiary. If you do, your pension benefit will be paid to your estate and distributed as outlined in your will.

This video introduces you to the importance of nominating your pension beneficiaries.

Sign in to My Account to view your current beneficiary information.

Preparing for retirement

When it’s time to apply for your pension, you have some important decisions to make. These decisions will affect the financial future of you and your loved ones. Take time to review the available resources and gather the documents you’ll need.

Looking for more information? Visit the links in the Related Content box for more details on the topics in the checklist.

One year before you retire

□ Get a pension estimate. Use the Personalized Pension Estimator in My Account to explore your pension options instantly.

□ Take an online course. Approaching retirement is a 45-minute online course.

□ Consider your beneficiaries. Think about who you will name as your primary beneficiary and alternate beneficiaries. Your spouse is automatically your primary beneficiary.

□ Learn about retirement health coverage. You can access extended health care and dental coverage through the plan when you apply for your pension.

□ Maximize your pension. You may be able to transfer prior service from another plan or buy back service for an approved leave. There are deadlines to apply.

□ Confirm your age and identity. Submit verification documents to the plan in My Account. Go to Personal Information in your My Account profile.

- If you changed your name, submit documents to show proof of your new legal name.

□ Tell us if you have or had a spouse. We need to know if you have a current or former spouse. Go to the Spouse Information section in your My Account profile.

□ Tell us how to divide your pension. This is necessary only if you are separated from a spouse and they have a claim to a portion of your pension. Upload your separation agreement or court order in your My Account profile.

□ Contact Service Canada. You may be eligible for the Canada Pension Plan and/or old age security pension. These may provide other sources of retirement income. Find out if you’re eligible and how to apply.

□ Book a one-on-one appointment with us. Ask a trained representative questions you have about your individual situation.

□ Talk with an independent financial advisor. They can help determine which pension option is best for your financial situation.

□ Inform your employer. Contact your employer in writing to arrange your last day of paid employment.

90 days before your pension effective date

Your pension effective date is the month you want to begin receiving your pension. The earliest you can apply for your pension is 90 days before your pension effective date. It's a good idea to apply as soon as you're able.

Occasionally, pension applications may take longer to process than usual. Please submit your application at least 30 days before the month you'd like to retire.

Apply for your pension online in My Account. Or request a paper application package. Visit Applying for your pension, under Pension Basics for next steps.

Looking for more detail? These links will help you

How pension contributions work

Taking time off work and buying service

Leaving WorkSafeBC and your pension plan

Beneficiaries and your pension